CHICAGO ILLINOIS PRIVATE MONEY LENDERS FOR CHICAGO FLIPPERS | FLIPPING CHICAGO

TYPES OF INVESTOR REHAB FIX AND FLIP LOANS

Hard Money Rehab Loans

Fix and flip loans are used when a real estate investor uses an investor rehab loan to quickly secure a distressed real estate property, receive funding for the repairs, and get the property back listed on the market.

At Tidal Loans we can provide up to 90% of the purchase price and 100% of the renovation costs to fix and flip investors for Illinois Real Estate investors. On a case by case basis we will finance up to 100% of the purchase and rehab cost as long as the purchase and rehab amount is within our 70% of the ARV (After Repair Value).

For our investor’s other states. (We lend nationwide except for Minnesota and North/South Dakota) We will fund up to 90% of the purchase price and 100% of the repairs. We may allow 100% CLTV, (Combined Loan to Value) Meaning we allow either the seller or another private lender to finance the remaining 10% of equity as a second note. That 10% is the amount the borrower would’ve had to bring to the closing table. This provides our borrower’s nationwide 100% fix and flip loans. The only funds our clients will have to bring to the closing table in this situation will be the closing cost

House Flipping Loans Without Rehab

There are many ways to make money in real estate. Another approach our clients is what we call in the industry as a “wholetail” flip. That is where the real estate investor purchases the property quickly directly from the seller and may or do some light repairs to the property, or just put it right on the market without repairs. The name of the game with off market deals is speed, and our private money loan options are key.

Buy, Rehab, Rent, Refinance (BRRR Strategy)

Our hard money lending program in Chicago is designed with a special emphasis on the Buy, Rehab, Rent, Refinance (BRRR) strategy to aid real estate investors. Just like our flip loans and construction loans, we extend funding for the acquisition and refurbishment of the property. However, the unique aspect here is that instead of selling the property for a profit, the investor

chooses to retain it as a cash generating rental property. This can be traditional rental or even Airbnb, for which we also offer short-term rental financing.

After a lease is signed (with no need for tenant occupancy yet), we then offer a cash-out refinance loan, calculated at up to 75% LTV of the appraised value. Our loan program is popular among real estate investors because it allows them to withdraw all their cash or equity from the property, often even more than their initial investment, and reinvest.

So, essentially, our program, offered by FBC Funding, is not just the BRRR strategy; it is BRRRR – Buy, Rehab, Rent, Refinance, and REPEAT! Our approach, unlike traditional loans, accommodates bad credit and focuses more on the investment property and the real estate investment strategy of the borrower. The loan application process is simple, ensuring you get the loan amount needed promptly to proceed with your real estate investing journey.

Private Money Investment Property Loans We Provide

Tidal Loans offers private investment property loan options throughout the Illinois area. If you already have a property that needs funding, you can talk to us about our:

Fix and Flip Loans

We fund up to 90% of the Purchase Price and 100% of the Repairs. We may allow 100% CLTV (100% fix and flip loans), so sellers can carry back a second note, allowing 100% of the purchase price and rehab amount to be financed. These loans are designed specifically for investors who are interested in rehab and renovations to a fixer upper that you’d like to then sell for profit. Allowing our clients to bring nothing but closing costs to the table!

New Construction Loans

For Investors, Builders and Developers. We fund up to 75% of the After-Construction Value. 85% LTC, and up to 100% of the hard construction cost. We can also assist with funding the land acquisition!

Rental Property Loans / DSCR Loan

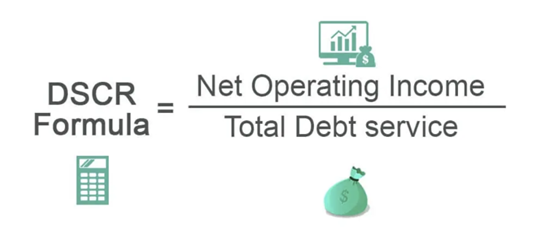

DSCR Loan Meaning: For our clients looking to hold their properties rather than flipping it. We offer a DSCR long term 30 year loan. What is a DSCR Loan? Our Debt Service Coverage Ratio (DSCR) loan is a type of financing commonly used in real estate investments. It measures the ability of a property’s income to cover its debt obligations. Rather than your personal income, as most banks would look at your personal DTI, we look at the properties DSCR.

DSCR Loan Requirements- We can provide a DSCR loan for Single Family Properties, 2-4 units, Multifamily properties, and Commercial Properties as well. We just need the following.

1.) Minimum credit score of 600

2.) Rent Ready Property

3.) Minimum Debt Service Coverage Ratio of at least .75 ( the higher the DSCR ratio the better the terms)

Calculating DSCR.

The DSCR ratio is calculated by dividing the property’s net operating income (NOI) for multi-family properties, or the rent income for 1-4 unit properties, by its total debt service, including principal, interest payments, taxes and insurance. A higher DSCR ratio indicates the deal has a better ability to cover debt payments and typically comes with better rates. Our DSCR loans are often sought by investors looking to purchase or refinance income-generating properties, such as commercial buildings or multi-unit residential complexes or 1-4 units. At Tidal Loans, we offer competitive DSCR loans that cater to the unique needs of real estate investors, providing them with the financial support necessary to grow their portfolios and achieve their investment goals..

Our landlord loans are great for buy and hold investors. Our program allows our clients to grow their portfolio faster. Investors can pull out up to 75% of the appraised value, even if you owned the property for just a week. We do not verify income either, because we care about the property cash flow, not our clients. Our rates start at very competitive and are 30 year fixed terms, 30 year amortization, allowing our rental property investors to cash flow more each month! We even have a 40 year amortization option as well!

Contact us today to explore our DSCR loan options and benefit from our expertise in the real estate lending industry

Transactional Funding

For wholesaler’s who need to double close with their seller. Tidal Loans will fund 100% of the closing with no cash out of pocket.

Multi Family Loans/ Mixed Used Loans

Our program consists of minimal down payment for multifamily apartment real estate investors looking for apartment rehab loans. We do not have a DSCR requirement for our multifamily rehab loans. Up to 85% LTC, 90% CLTV and 100% of rehab funds. This exclusive loan program for apartment buildings provides you with the flexibility and leverage to profit on Multifamily & Mixed-use investment opportunities that may need rehab or low occupancy. We also offer a 30-year loan program for investors looking to cashflow their property long term.

Commercial Property Loans

We provide private commercial hard money loans for commercial real estate investors. We provide loans up at 65% LTV for our commercial bridge loans and commercial rehab loans. We offer 70% LTV and 80% CLTV on our long term commercial hard money loans at a 30-year amortization with a 30 year term. A commercial hard money loan is a good alternative to traditional bank financing when time is of the essence or borrowers don’t meet traditional guidelines for whatever reason.

Airbnb Financing

Airbnb Loans / Short Term Rental Loans: We provide our buy at property. 30-year fix rate up to 80% LTV. We know the struggle with financing for Airbnb properties that is why we came up with this loan option for our Airbnb hosts! Buying a house for short term rental to place on Airbnb or VRBO is easy with Tidal Loans.

Non Recourse Financing: The main benefit of non-recourse financing is the borrower does not guarantee the loan. We are non-recourse loan lenders. We provide non recourse loans for a fix and flip loans, purchase loans, and short term cash out refinance loans.

Real estate investors feel free to reach out to us and see why we are considered to be one of the best hard money lenders Nationwide! We pride ourselves in offering a simple, fast, and transparent private money loan for your real estate investment needs. Avoid the red tape that goes along with bank financing and the time it takes to close traditional loan structures and look into a hard money loan with Tidal Loans.

Economic Breakdown

| CASH OUT REFINANCE |

| Loan Amount- $123,750 |

| Property Value-$170,000 |

| Loan Type- CASH OUT REFINANCE |

| TERM- 24 MONTHS |

| Monthly Interest Only Payment- $928 |

See How We Made Funding a Reality for Others