A sunny day, and you are relaxing on the porch by the seaside! Who in their right mind won’t fantasy such a magnificent predicament? Well, to turn this fantasy into a reality, a concrete financial plan is required. The process, however, appears overwhelming for most people.

With proper knowledge and resources, you can overcome the challenges without a hitch. In this article, I will dive deep into how you can finance and secure a Bayside waterfront home in Ocean City, MD.

Best Path to Tail: Fund a Dreamy Seaside Waterfront Home

As dreamy as it sounds, the market for waterfront properties in Ocean City, MD is strong. It is growing rapidly with buoyant demand. And it’s quite easy to find cottages, modern beach houses, and luxury estates that are up for sale. Coastal living with stunning ocean views, private docks, and upkeep with local attractions are the key selling points.

Now the predominant inconvenience to owning such property at Bayside in Ocean City is the money. However, loans are the most efficient way to crack this. Prospective customers can leverage their savings, elongate their payments, and benefit from the auspicious interest rates.

For good measure, customers can tailor loans according to their circumstances. Therefore, they will enjoy the flexibility to manage investments. As a result, financial reserves are barely squandered.

Feasible Loan Types

Speaking of loan types, there are quite a few options to choose from. Each has unique perks and is curated for different financial situations. Let’s run through them quickly.

Conventional Loans

Competitive interest rates and ultimate flexibility, that’s how conventional loans can be characterized. The federal government does not insure these loan schemes, which makes them ideal choices for people with strong credit and financial situations.

The down payment starts at a low 3%, with a variety of term durations. This is especially helpful to work around a buyer’s budget.

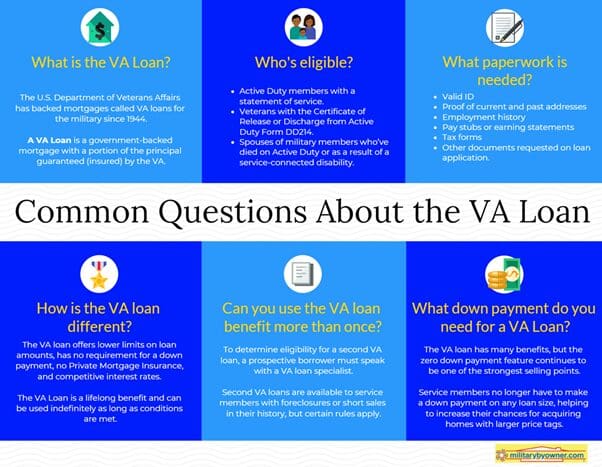

VA Loans

No down payments, no private mortgage insurance (PMI), and competitive interest rates transform Veteran Affairs or the VA loans into the most desirableschemes out there. Veterans, active duty service members, or eligible surviving spouses, however, are eligible for this.

FHA Loans

For first-time homebuyers with inadequate credit, Federal Housing Administration (FHA) loans are put into place. A 3.5% down payment with lower credit requirements paves the way to easily becoming a property owner at Bayside in Ocean City.

FHA guarantees these loans to mitigate risk for the providers and create an easy infrastructure for buyers to qualify.

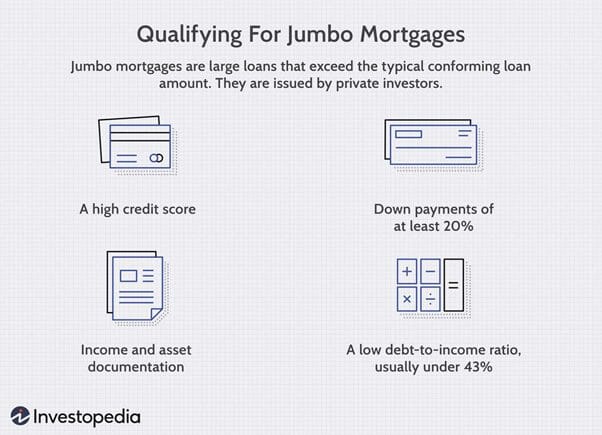

Jumbo Loans

Strong creditholders who are willing to buy luxury bayside properties can take advantage of jumbo loans. That’s mostly due to their strict credit requirements, absurdly high down payments (at least 20%), and low debt-to-income (<43%) ratio. But the outcome is some extraordinary waterfront properties.

Preparation for the Loan Process

1. Evaluating your financial status.

First things first, thoroughly assess your economic situation. This should include credit score, income, debt-to-income ratio, and overall financial health. By doing this, you are clear about what you can afford and what you are after. Also, you now know where you need to make adjustments to secure a better loan scheme.

2. Estimation

The very next step is to predict the total cost of obtaining a Bayside waterfront home. You must calculate the down payment, monthly mortgage payments, insurance, property taxes, and maintenance costs.

Once you are through, you’ll have a clear picture of where your financial situation should stand to go with the loan.

3. Find the best mortgage rates

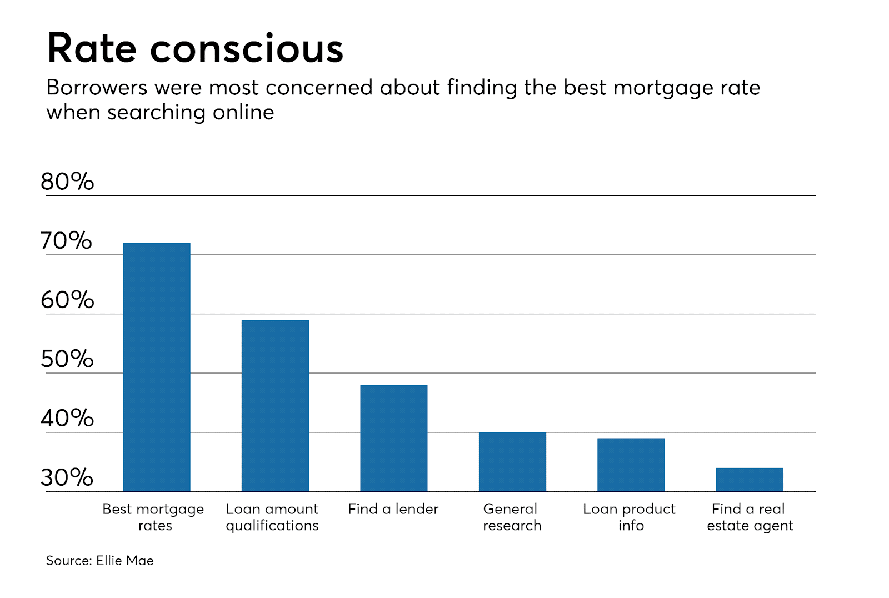

Now that you know what you can afford and what commitment you are up for, hunting the perfect mortgage rate is crucial. This will save you thousands of dollars during the entire loan period. So, don’t just rely on a single vendor, rather do thorough market research on who offers the better rates and terms.

Speaking of market research, use tools at your disposal such as mortgage rate comparison websites and financial news portals. Over 70% of people search online to find the best mortgage rates.

These online resources will provide you with a comprehensive look at current rates from all possible lenders. The best thing is that you’ll get real-time updates and personalized estimates based on your financial profile.

The next phase is to negotiate wisely. You need to aim for suitable terms that include affordable interest rates, cut-down fees, and payment flexibility. Be discreet and point out the strong side of the credit history, income stability, and the offers you’ve received already. This will give you an upper hand.

4. Collaborate with Real Estate Professionals

Touching on negotiation, mortgage brokers can be invaluable. They know the correct people and have the resources to secure the perfect loan scheme. Also, they are experienced with paperwork and simplify the application process.

In addition, real estate agents can positively influence the buying process. From triangulating perfect property and negotiating offers to closing the deal, their expertise makes the entire process effortless.

5. Prepare the necessary papers and create a loan application

Paperwork is intimidating, especially for a loan application. A single missing document can put things upside down. Therefore, arrange your papers flawlessly. They have to be up-to-date as well.

Here’s an example of the necessary documents:

- Proof of income (pay stubs, tax returns).

- Bank statements.

- Credit reports.

- Proof of assets that includes savings and investments.

- Employment verification.

- Identification documents (driving license or passports).

Based on lenders, paperwork may vary. Create a checklist to keep track of whether you have all the necessary documents.

Pre-Approval Process

Before the final phase, let your lender review your financial status to determine the loan amount you qualify for.

This will provide you with the following benefits:

- Prove to the seller that you’re not bluffing.

- Speeds up the closing process.

6. Seal the deal

At this stage, your loan will be approved. Yet you need to finalize the process and sign the papers. But before that, read the clauses carefully. Don’t sign without going over them multiple times if you need to. Make sure you understand repayment schedules, interest rates, and other additional fees.

Here’s a breakdown of typical closing costs for waterfront properties:

- Loan origination fees.

- Evaluation fees.

- Insurance.

- Home inspection fees.

- Property taxes.

- Recording costs.

As a real estate expert, I suggest you set aside 2-5% of the house’s total buying price. And get a meticulous estimate to steer clear of being surprised by hidden costs at the final moment.

Summary

Waterfront homes in Ocean City are not far-fetched at all as it seems at first glance. Careful consideration and a proper approach are all you need to attain a property. It includes assessment of economic status, cost estimation, finding appropriate mortgage rates, and applying for the correct loan plan.