Hard money lending has emerged as a pivotal mechanism in the realm of real estate investments, offering an alternative route to traditional financing. In the thriving city of Fort Worth, TX, Tidal Loans LLC stands out as a leading provider of hard money loans. These financial tools are not only crucial for investors but also for the overall growth of the real estate sector in the region.

Market Overview in Fort Worth, TX

The real estate market in Fort Worth has witnessed significant growth, with a notable 1.82% increase in population and an 11.5% rise in median property values. This growth reflects a vibrant market ripe for investment, especially in the broader Dallas-Fort Worth area. Fort Worth hard money loans have become instrumental in facilitating these investments.

Demographic Dynamics in Fort Worth

Fort Worth’s population is not only growing but diversifying, with a median age of 33 and a foreign-born population of 16.7%. This demographic shift is influencing the real estate market, with diverse housing demands emerging across the city.

Residential Real Estate in Fort Worth

The residential sector in Fort Worth is diverse, encompassing both single-family and multi-family homes. The market is balanced with new constructions and existing homes, presenting varied opportunities for investment.

Commercial Real Estate in Fort Worth

Commercial properties in Fort Worth are in high demand, driven by economic growth. From retail spaces to office buildings, investors have a plethora of options to explore.

Rental Market Dynamics in Fort Worth

Fort Worth’s rental market is dynamic, with varying yields and occupancy rates. Investors need to weigh the benefits of short-term versus long-term rentals to maximize returns.

Household Income and Housing Affordability

The median household income in Fort Worth stands at $67,927, influencing the housing affordability in the city. The economic stratification further impacts the real estate market, affecting both pricing and demand.

Employment Growth and Real Estate Demand

Fort Worth’s employment sector is thriving, directly impacting the real estate demand. Key industries in the area not only bolster employment but also shape the housing market.

Infrastructure and Real Estate in Fort Worth

Infrastructure developments in Fort Worth play a significant role in shaping the real estate landscape. These projects can significantly affect property values and investment attractiveness.

Property Taxation and Regulation in Fort Worth

Understanding property tax rates and real estate regulations is essential for investors. Legislative changes can have substantial impacts on property owners and investors.

Zoning and Development Laws

Zoning regulations in Fort Worth influence property usage and development strategies, making them crucial for investment planning.

Interest Rates and Lending Trends

The lending landscape in Fort Worth, including interest rates, significantly impacts real estate financing and investment decisions.

Analyzing Investor Trends

Investor activity in Fort Worth’s real estate market influences the dynamics of the sector, affecting both residential and commercial properties.

Long-Term Market Forecasts

Long-term growth projections and potential market saturation points are essential for strategic investment planning in Fort Worth.

Strategic Insights for Investment

Investors are advised to consider optimal timing and niche opportunities in Fort Worth’s real estate market for maximum returns.

How Can Hard Money Lenders in Fort Worth Texas Help Grow Your Real Estate Portfolio?

Hard money lenders in Fort Worth TX, such as Tidal Loans provide an alternative route for financing real estate projects. We offer different types of loans such as hard money loans, flip loans, construction loans, and bridge loans. These financial products are designed specifically to suit the varied requirements of real estate investors. The primary emphasis of a hard money lender is on the potential value of the investment property and not exclusively on the borrower’s credit score. This focus on the property’s worth can provide funding opportunities for investors with less-than-stellar credit histories, enabling them to participate in the real estate market.

Fort Worth hard money lenders also stand out due to their ability to fund loans faster than traditional lenders. This expedited process can be crucial in a competitive market where quick action often determines whether an investor secures a deal or not. For instance, flip loans can assist an investor in quickly purchasing a property, renovating it, and selling it for a profit. Construction loans can be crucial for new projects, while bridge loans offer short-term solutions for investors between the buying and selling process. The flexibility of loan programs and the potential for a higher loan amount, based on the after-repair value of the property, make hard money lending a valuable tool for Texas real estate investors navigating the dynamic and competitive Fort Worth market.

Why Choose Tidal Loans LLC?

Tidal Loans LLC’s deep understanding of the Fort Worth market and its expertise in hard money lending make it a preferred choice for investors seeking quick funding and flexible terms.

- Quick Approval/Denial and Funding:

- Prompt decision-making is crucial for real estate investors, and Tidal Loans LLC understands the urgency. We streamline the origination process, providing swift approval or denial, and ensure rapid funding. This agility is essential in the fast-paced real estate market where good deals are time-sensitive.

- Real Estate Experience:

- Having a team, including our account executives, with firsthand experience in real estate investment is helpful. This unique perspective allows us to offer valuable insights to our clients, including market trends, deal structuring expertise, and assistance with due diligence. We speak the language of real estate investors because we are investors ourselves.

- Personalized Approach:

- We recognize that capital can sometimes become commoditized, so we distinguish ourselves by prioritizing personalized relationships with our clients. Our account executives go the extra mile by meeting local clients at project sites and conducting virtual meetings. Building strong connections enables us to better understand and cater to the individual needs of our clients.

- Exit Strategy Guidance:

- We go beyond traditional lending by underwriting loans with the end in mind. For example, if the exit strategy involves refinancing into a longer-term loan, we proactively structure the deal during the initial underwriting. This forward-thinking approach ensures that our clients have a clear and feasible path to their desired exit strategy.

Our Hard Money Loan Products

At Tidal Loans, we extend our comprehensive suite of private money investment property loans to the vibrant Fort Worth, TX market. Our expert team understands the unique opportunities this area presents and offers tailored financial solutions to support your real estate ambitions.

Fix and Flip Loans

Maximize your profits in Fort Worth’s dynamic property market with our Fix and Flip Loans. We offer up to 100% funding of both purchase price and repair costs, with competitive loan-to-value ratios. Our swift financing ensures you can close deals quickly, turning distressed properties into lucrative investments.

We are one of the few lenders that can fund up to 100% of the Purchase Price and 100% of the Repairs for experienced borrowers because we are lending our own capital! We allow 100% CLTV( 100% fix and flip loans case by case as well), so sellers can carry back a second note, allowing 100% of the purchase price and rehab amount to be financed. These loans are designed specifically for investors who are interested in purchasing an investment property fixer upper to rehab or renovate to then sell for profit. Allowing our clients to bring nothing but closing costs to the table!

New Construction Loans

Builders and developers in Fort Worth can benefit from our New Construction Loans, providing up to 70% of the post-construction value and covering 100% of the hard construction costs. Our support extends to land acquisition, helping to lay the foundation for your new projects.

Rental Property Loans

Secure your long-term investments with our Rental Property Loans, perfect for buy-and-hold strategies in Fort Worth’s growing rental market. With loan terms designed for cash flow and growth, you can leverage up to 80% of property value without the hassle of income verification.

What is a DSCR Loan in Fort Worth, Texas?

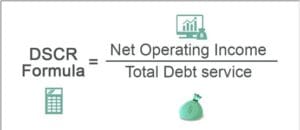

For our clients looking to hold their properties rather than flipping it. We offer a DSCR long term 30 or 40 year loan. Our Debt Service Coverage Ratio (DSCR) loan is a type of financing commonly used in real estate investments. It measures the ability of a property’s income to cover its debt obligations. Rather than your personal income, as most banks would look at your personal DTI, we look at the properties DSCR.

How do we calculate the DSCR ratio? The DSCR ratio is calculated by dividing the property’s net operating income (NOI) by its total debt service, including principal and interest payments. A higher DSCR ratio indicates the deal has a better ability to cover debt payments and typically comes with better rates. Our DSCR loans are often sought by investors looking to purchase or refinance income-generating properties, such as commercial buildings or multi-unit residential complexes or 1-4 units. At Tidal Loans, we offer competitive DSCR loans that cater to the unique needs of real estate investors, providing them with the financial support necessary to grow their portfolios and achieve their investment goals. Contact us today to explore our DSCR loan options and benefit from our expertise in the real estate lending industry.

DSCR Loan Meaning: For our clients looking to hold their properties rather than flipping it. We offer a DSCR long term 30 or 40 year loan. What is a DSCR Loan? Our Debt Service Coverage Ratio (DSCR) loan is a type of financing commonly used in real estate investments. It measures the ability of a property’s income to cover its debt obligations. Rather than your personal income, as most banks would look at your personal DTI, we look at the properties DSCR.

DSCR Loan Requirements- We can provide a DSCR loan for Single Family Properties, 2-4 units, Multifamily properties, and Commercial Properties as well. We just need the following.

1.) Minimum credit score of 600

2.) Rent Ready Property

3.) Minimum Debt Service Coverage Ratio of at least .75 ( the higher the DSCR ratio the better the terms,)

Calculating DSCR.

The DSCR ratio is calculated by dividing the property’s net operating income (NOI) for multi-family properties, or the rent income for 1-4 unit properties, by its total debt service, including principal, interest payments, taxes and insurance. A higher DSCR ratio indicates the deal has a better ability to cover debt payments and typically comes with better rates. Our DSCR loans are often sought by investors looking to purchase or refinance income-generating properties, such as commercial buildings or multi-unit residential complexes or 1-4 units. At Tidal Loans, we offer competitive DSCR loans that cater to the unique needs of real estate investors, providing them with the financial support necessary to grow their portfolios and achieve their investment goals..

Our landlord loans are great for buy and hold investors. Our program allows our clients to grow their portfolio faster. Investors can pull out up to 75% of the appraised value, even if you owned the property for just a week. We do not verify income either, because we care about the property cash flow, not our clients. Our rates start at very competitive and are 30 year fixed terms, 30 year amortization, allowing our rental property investors to cash flow more each month! We even have a 40 year amortization option as well!

Contact us today to explore our DSCR loan options and benefit from our expertise in the real estate lending industry

Multifamily and Mixed-Use Loans

Fort Worth’s multifamily and mixed-use properties are ripe for investment, and our loan programs reflect that. Our program consists of minimal down payment for multifamily apartment real estate investors looking for apartment rehab loans. We do not have a DSCR requirement for our multifamily rehab loans. Up to 85% LTC, 90% CLTV and 100% of rehab funds. This exclusive loan program for apartment buildings provides you with the flexibility and leverage to profit on Multifamily & Mixed-use investment opportunities that may need rehab or low occupancy. First time investors allowed as well! We also have a 30-year multi family loan program for investors looking to cashflow their property long term.

Commercial Property Loans

Take advantage of Fort Worth’s commercial real estate prospects with our private commercial hard money loans. Offering significant LTV ratios and 30-year terms, we’re the go-to alternative for those seeking quick and straightforward financing solutions.

Airbnb Financing

Embrace Fort Worth’s tourism and short-term rental markets with our Airbnb Financing options. With competitive fixed rates for up to 30 years, we make it easier to become an Airbnb host and expand your property portfolio.

We know the struggle with financing for Airbnb properties that is why we came up with this loan option for our Airbnb hosts! Buying a house for short term rental to place on Airbnb or VRBO is easy with Tidal Loans.

Non-Recourse Financing

Experience the security of non-recourse financing, where the loan does not require a personal guarantee, giving you peace of mind and financial autonomy.

Join the ranks of successful investors who have chosen Tidal Loans for their real estate ventures in Fort Worth, TX. Discover the difference of partnering with a lender that prioritizes speed, simplicity, and transparency. Reach out to us today and let us help you achieve your real estate investment goals.

The Tidal Loans LLC Difference

Tidal Loans LLC distinguishes itself with fast approval and funding times, coupled with personalized service that caters to the diverse needs of Fort Worth’s real estate investors.

Application Process

The application process at Tidal Loans LLC is streamlined and efficient, designed to assist borrowers in navigating the loan acquisition process with ease.

Contact and Consultation

Potential borrowers are encouraged to contact Tidal Loans LLC for a free consultation to discuss their real estate investment plans in Fort Worth.

Conclusion

Tidal Loans LLC offers a comprehensive suite of hard money loan products tailored to the needs of Fort Worth’s dynamic real estate market. The company’s deep local expertise and commitment to client success make it an ideal partner for both novice and experienced investors in the region.

Contact Tidal Loans